Checking Out the Foreign Earned Earnings Exemption and Just How It Connects to Your Standard Reduction

The Foreign Earned Revenue Exemption (FEIE) provides a significant opportunity for expatriates to reduce their U.S. tax obligation liability. Recognizing the qualification demands and calculating foreign gained income is essential. This exclusion complicates the option in between optimizing and claiming the conventional deduction tax advantages. Navigating through these complex guidelines can cause substantial economic implications. What strategies can people use to enhance their tax obligation circumstance while staying certified with IRS guidelines?

Comprehending the Foreign Earned Income Exclusion (FEIE)

Although several united state citizens functioning abroad may deal with complex tax obligation commitments, the Foreign Earned Income Exemption (FEIE) supplies significant relief by enabling qualified people to omit a section of their international revenues from U.S. tax. This provision is made to ease the financial problem of double tax on earnings earned in international countries. By utilizing the FEIE, qualified taxpayers can leave out approximately a defined restriction of international earned revenue, which is readjusted every year for inflation. The exemption applies only to income originated from work or self-employment in a foreign country and does not cover other kinds of income, such as investment income. To benefit from the FEIE, individuals should submit the appropriate tax return with the internal revenue service and guarantee compliance with details requirements. Inevitably, the FEIE acts as a necessary tool for U.S. residents steering the intricacies of international tax while living and working abroad.

Eligibility Requirements for the FEIE

To get the Foreign Earned Income Exclusion (FEIE), individuals should satisfy specific requirements established by the IRS. They need to have international gained income, which refers to salaries, wages, or specialist charges obtained for services done in an international nation. Furthermore, the taxpayer has to either be an authentic homeowner of a foreign country or fulfill the physical presence examination, which requires spending a minimum of 330 complete days in a foreign country during a 12-month duration.

Furthermore, the taxpayer has to submit Form 2555 or Kind 2555-EZ to assert the exclusion. It is also vital to note that the FEIE applies just to income earned while staying outside the USA; consequently, any earnings from united state resources or for services done in the united state does not certify. Comprehending these eligibility demands is crucial for individuals looking for to take advantage of the FEIE.

Determining Your Foreign Earned Earnings

Calculating international made revenue is essential for individuals seeking to gain from the Foreign Earned Revenue Exclusion - FEIE Standard Deduction. This procedure includes comprehending the definition of international earned income and the details qualification needs that apply. Additionally, different estimation methods can be utilized to accurately identify the quantity eligible for exemption

Meaning of Foreign Earned Earnings

Foreign gained revenue encompasses the payment gotten by individuals for solutions executed in a foreign nation. This earnings can consist of incomes, wages, incentives, and professional fees made while functioning abroad. It is crucial to note that international earned earnings is not limited to simply cash repayments; it can also incorporate non-cash benefits, such as housing allowances or the worth of dishes supplied by an employer. To qualify as foreign earned income, the compensation must be acquired from services carried out in an international area, not from united state sources. Comprehending this meaning is crucial for people looking for to navigate the complexities of tax guidelines related to making earnings overseas, specifically when considering the Foreign Earned Earnings Exemption.

Eligibility Needs Explained

Qualification for the Foreign Earned Earnings Exemption rests on a number of crucial demands that people have to satisfy to guarantee their earnings qualifies - FEIE Standard Deduction. To begin with, the individual should have foreign made revenue, which is income obtained for services done in an international nation. On top of that, they must satisfy either the bona fide house examination or the physical presence test. The authentic residence test needs people to be a homeowner of a foreign country for an uninterrupted period that includes an entire tax year. Conversely, the physical visibility test demands being existing in a foreign nation for a minimum of 330 complete days during a 12-month period. In addition, taxpayers have to file a valid tax obligation return and claim the exemption using Kind 2555

Computation Techniques Review

When identifying the amount of international earned revenue eligible for exclusion, people must think about various computation techniques that accurately show their earnings. The most typical methods include the Physical Visibility Test and the Authentic Home Examination. The Physical Existence Test needs people to be physically present in an international country for a minimum of 330 days within a twelve-month duration. On the other hand, the Bona Fide Home Test puts on those that develop a permanent home in a foreign country for a continuous period. Each method has particular criteria that should be fulfilled, affecting the amount of income that can be excluded. Recognizing these estimation techniques is vital for making the most of the advantages of the Foreign Earned Income Exemption and making certain conformity with internal revenue service guidelines.

The Duty of the Criterion Deduction

The basic deduction plays a crucial role in private tax filings, supplying taxpayers with a set reduction in their taxed earnings. When integrated with the Foreign Earned Earnings Exemption, it can greatly impact the overall tax liability for expatriates. Understanding just how these two elements interact is vital for maximizing tax advantages while living abroad.

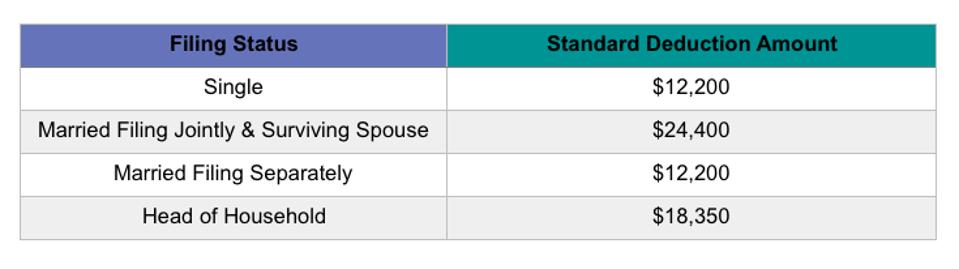

Criterion Reduction Introduction

Recognizing the conventional reduction is important for taxpayers looking for to minimize their gross income. The common deduction stands for a set buck amount that decreases the revenue based on taxation, simplifying the declaring procedure. It differs based on declaring condition-- single, wedded declaring jointly, wedded filing independently, or head of family. For many taxpayers, specifically those without substantial itemized reductions, choosing the common deduction might be useful. This reduction is changed each year for rising cost of living, guaranteeing its relevance over time. By using check the typical reduction, individuals can properly decrease their tax obligation responsibility, making it a critical element of tax obligation preparation. Ultimately, understanding of the conventional deduction encourages taxpayers to make educated decisions regarding their financial approaches.

Interaction With Foreign Exclusion

Taxpayers living abroad may profit from both the common reduction and the Foreign Earned Income Exemption (FEIE) The FEIE allows eligible people to omit a significant section of their international income from united state tax, while the standard deduction lowers taxable revenue for all taxpayers. Notably, the conventional reduction can still use also when using the FEIE. Nonetheless, taxpayers need to keep in mind that the FEIE does not influence the calculation of the typical deduction. Solitary filers can declare the common reduction quantity regardless of their foreign income exemption. This mix can cause significant tax obligation financial savings, allowing migrants to reduce their overall tax responsibility successfully while making sure compliance with united state tax obligation commitments.

Just How FEIE Affects Your Typical Deduction

Steering the interplay between the Foreign Earned Earnings Exemption (FEIE) and the conventional reduction can be intricate for migrants. The FEIE permits certifying individuals to omit a particular quantity of their international gained earnings from united state taxation, which can substantially influence their general tax obligation responsibility. It is important to keep in mind that asserting the FEIE might affect the ability to make use of the common deduction.

Specifically, if an expatriate elects to leave out foreign earned income, they can not assert the typical reduction for that tax year. Rather, they might be eligible for an international tax obligation credit report, which can be beneficial in particular circumstances. The choice to utilize the FEIE or the common deduction calls for cautious consideration of private situations, as it can modify the tax landscape considerably. Recognizing these implications is important for migrants looking for to enhance their tax responsibilities while living abroad.

Strategies for Optimizing Your Tax Obligation Benefits

While maneuvering with the complexities of expatriate tax, people can employ numerous strategies to optimize their tax advantages. One reliable method entails optimizing the Foreign Earned Earnings Exemption (FEIE) by guaranteeing that all certifying revenue is accurately reported. By prompt declaring Form 2555, expatriates can omit a significant portion of their earnings, decreasing their overall taxed quantity.

Furthermore, people must consider their residency standing and how it affects their eligibility for tax benefits. Leveraging readily available reductions, such as housing expenses, can additionally boost tax obligation savings. Taking part in tax planning throughout the year, as opposed to waiting until tax obligation period, allows expatriates to make enlightened monetary choices that align with their tax obligation method.

Last but not least, speaking with a tax specialist experienced in expatriate taxes can offer tailored understandings, ensuring compliance while making the most of offered benefits. Through these strategies, migrants can efficiently navigate the complexities of their tax obligation obligations.

Typical Mistakes to Avoid With FEIE and Deductions

Maximizing the benefits of the Foreign Earned Earnings Exemption (FEIE) calls for mindful focus to detail to avoid typical mistakes that can undermine tax financial savings. One constant error involves stopping working to satisfy the residency requirements, which can result in incompetency from the exclusion. Another usual mistake is incorrectly calculating the qualified foreign gained earnings, leading to potential over- or under-reporting. Taxpayers might also forget the requirement to file Kind 2555, crucial for asserting the FEIE, or misinterpret the partnership between the FEIE over at this website and the typical reduction. It's vital to keep in mind that while the FEIE can decrease gross income, it does not influence the conventional reduction amount, which might cause complication. Neglecting to preserve correct documentation, such as evidence of residency and income resources, can complicate audits or future cases. Awareness of these errors can aid individuals navigate the intricacies of worldwide taxes better.

Frequently Asked Concerns

Can I Declare FEIE if I Function Remotely for a United State Company?

Yes, an individual can declare the Foreign Earned Revenue Exemption if they work remotely for an U.S. company, supplied they fulfill the qualification requirements related to residency and physical existence in a foreign country.

Exactly how Does the FEIE Impact My State Tax Obligations?

The Foreign Earned Revenue Exemption usually does not impact state taxes directly, as policies differ by state. Some states might need citizens to report all earnings, while others line up with federal exclusions. Specific conditions will certainly figure out responsibility.

Can I Switch Between FEIE and the Foreign Tax Obligation Credit Report?

Yes, people can switch over in between the Foreign Earned Earnings Exemption and the Foreign Tax Credit Score. They should thoroughly consider the implications and constraints of each alternative for their certain monetary circumstance and tax year.

What Happens if I Go Beyond the FEIE Revenue Limitation?

Going Beyond the Foreign Earned Earnings Exclusion restriction leads to taxable income for the excess quantity. This can lead to enhanced tax responsibility and prospective issues in claiming reductions or debts connected to foreign income.

Does FEIE Use to Self-Employed Individuals?

Yes, the Foreign Earned Income Exemption (FEIE) puts on self-employed individuals (FEIE Standard Deduction). They can exclude qualifying foreign earned earnings, given they fulfill the necessary requirements, such as the physical presence or authentic residence tests

The exclusion applies only to income derived from employment or self-employment in a foreign country and does not cover other types of income, such as investment income. Determining foreign earned income is necessary for people looking for to profit from the Foreign Earned Earnings Exemption. To begin with, the private need to have international gained revenue, which is earnings look at this website gotten for services carried out in a foreign country. The FEIE permits qualified people to leave out a substantial portion of their international income from United state taxes, while the typical reduction lowers taxed income for all taxpayers. One effective strategy includes optimizing the Foreign Earned Income Exclusion (FEIE) by ensuring that all certifying earnings is accurately reported.